The Validus Platform

Designed by practitioners, shaped by clients

Coverage across all lines of defense

In building Validus, we continually engage with clients, listen to their unique needs, and shape our platform to meet their demands.

Trade

Surveillance

Actionable alerts, rich investigative tools, and a full-suite of customizable procedures for insider trading, market manipulation, and compliance.

Risk

Controls

Review compliance with written supervisory procedures and financial limits by confirming that pre-trade risk systems are working properly.

Algo

Monitoring

Real-time, at-scale coverage to detect disruptive algorithmic trading to reduce risk, increase transparency, and enable regulatory compliance.

Unparalleled coverage

Expertise

Founded by compliance practitioners and capital market experts frustrated with other solutions, Validus is built for at-scale multi-asset compliance, across all lines of defense.

Engagement

Ongoing conversations with clients keep Validus cutting-edge with powerful analytics, charting tools, visualizers, and an expanded services package with rapid response.

Engineering

Trusted by the most sophisticated firms in the industry, the Valdius platform is battle-tested in large high-volume trading, flexible to shifting requirements, and scales with our clients.

Validus features

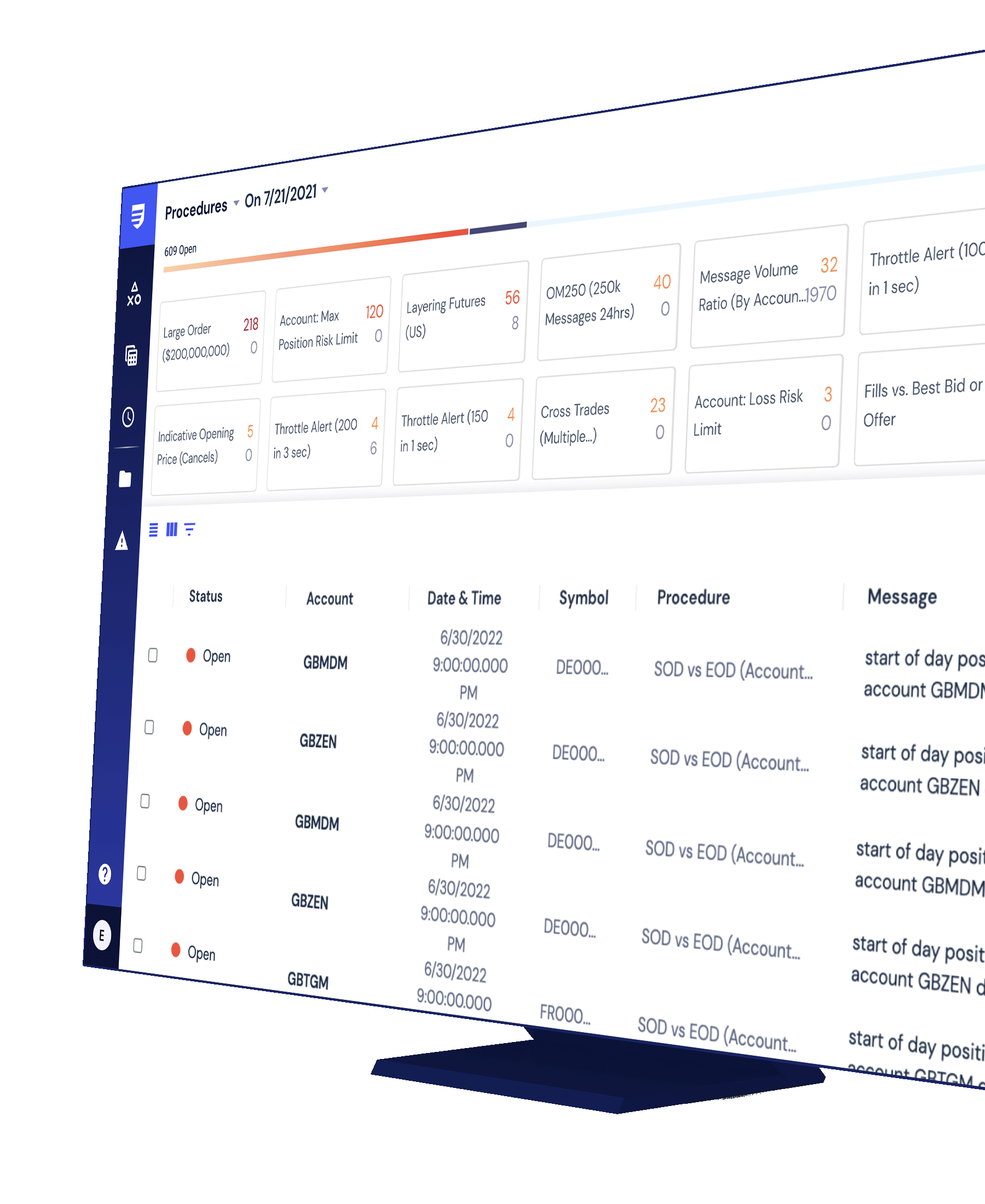

Intuitive alert workflow

Workflow management with custom tagging, escalations, and continuity across alert dispositions.

Automations

Reduce false positives and focus on actionable alerts with Robotic Process Automation and supervised machine learning.

Advanced analysis

Investigative tools and rich visualizations display order lifecycle and market data for alert insights and quick resolution.

Flexible coverage

150+ procedures based on our expertise and customer insights, plus the ability to personalize any procedure.

Powerful reporting

Centralized reporting interface (Compliance Home) showcasing all preferred and custom reports.

Data integration

Interoperability with third-party data for comprehensive coverage across capital markets datasets.

Efficient ingest of your data

Full service, efficient methodology to import and update your data in any format.

Risk controls & algo monitoring

Review of financial limits and written supervisory procedures, and real-time monitoring of algorithmic trading.

150+

Customizable procedures across asset classes

85%

Of candidate alerts resolved by automation on average

150,000+

Message bursts per second in real-time

Across all lines of defense

- Protects trading desks with real-time procedures that cover excessive messaging, duplication of orders, clearly erroneous events, and risk limits

- Empowers the compliance team with customizable procedures that cover market manipulation across asset classes and global regions

- Supports the audit function with reports on order and trade data life cycles, and on how proficiently the surveillance team has resolved alerts

“As we have begun to provide direct market access as a routing broker and grown in our futures offering, which is subject to a different regulator, we wanted to make sure we chose a trade surveillance platform that has all the tools that we need, a format we can review easily, and capabilities to demonstrate to regulators that we have the proper trade surveillance procedures in place. Validus checks all the boxes for us.”

Karl Jones, Chief Compliance Officer, SpiderRock

State-of-the-art trade surveillance

Discuss your compliance requirements with our team .